Revenue-Sharing Business Model is the new way to start your business online without any initial investment. This model has been proven successful by many people who have already started their success stories with revenue sharing.

Several start-ups around the globe use the revenue-sharing business model. The model is used to attract new entrepreneurs and retain their current ones. By offering ownership of future revenues to the participants. The model creates a long-term relationship between the entrepreneurs and their members.

What Is Revenue Sharing Business Model?

The revenue sharing model is a business model in which a company gives a percentage of its revenue to the partner in exchange for access to the partner’s resources. The revenue sharing model is used by companies that want to work with partners outside their direct network. But don’t have the resources or expertise to do so.

For example, let’s say you’re a small company and want to sell your products online. But selling online isn’t something you’ve done before. You don’t have the expertise or even know who would be able to help you with it.

So instead of hiring someone who specializes in that area and then paying them out of pocket. You choose a revenue-sharing agreement with another company that has experience selling online and can provide support. In contrast, they get paid by taking a percentage of your sales.

This model has become increasingly popular with businesses with limited startup capital. But still need help getting their name out there.

Also Read:

What Is Revenue Share In Affiliate Marketing?

Top 5 Benefits Of Lead Generation Services

Website Traffic Generation – Everything You Need To Know

How Does Revenue Sharing Model Work In Business?

As we have mentioned above, the Revenue sharing model is a business model. Where the company doesn’t get any profit from their product. Still, they get a percentage of the sales revenue. It can be used in many different ways. But it is often used to help startups get their products out into the world.

A company will use this model when they want to help a smaller company grow. While still making sure they’re getting something back for their investment. Let us give you a simple example to understand better how it works.

Let’s suppose you wanted to open up your coffee shop. You could partner with one of the big coffee chains like Starbucks or Dunkin’ Donuts. And have them sell your coffee under their name instead of yours.

You’d give them part of your profits in exchange for letting you sell your products at their locations. So that customers would know where their cups came from when they order them at Starbucks.

This way, both companies benefit: The big chain gets more customers who already know what they’re ordering from having seen it before on TV or billboards. And the small business gets instant exposure because its product is now being sold on a much larger scale. That would otherwise not be possible without help from someone else’s brand name recognition.”

Advantages And Risks Of Revenue Sharing

If you’re looking to grow your brand, revenue sharing can be an excellent way to do it. Revenue sharing allows you to partner with other companies to increase your revenue. And gain access to a wider audience that may not have been available otherwise.

However, this strategy has some advantages and risks that should be considered before entering into any agreement with another organization. Revenue Dealer now outlines the benefits of revenue sharing and potential risks if you decide this is the right direction for your business.

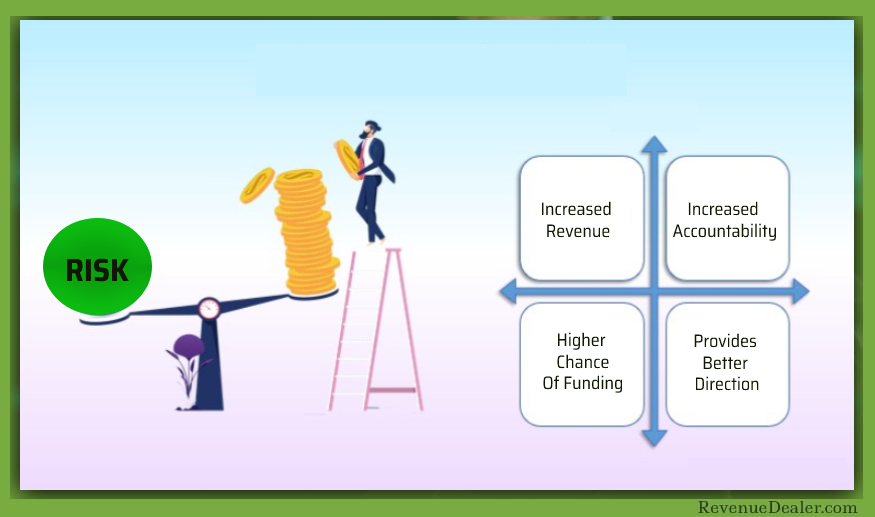

Increased Revenue

One benefit of the Revenue Sharing model is that it can increase your revenue. But it’s important to understand that there are no guarantees. The amount of money you make will depend on the number of impressions and clicks your ads receive.

The revenue sharing model is a great way to increase your revenue without taking on the risk of creating a new product. It’s a simple, low-risk way to make money from an existing product you already know is popular. You need to find someone who can help you sell it.

A Limited Number Of Partners

Revenue sharing is great for getting more partners. It’s an excellent way to get more companies on board. And it’s also a good way to get people who have never worked with you before.

It’s important not to overdo revenue sharing; if you’re too generous with your partners, they’ll become less committed. The key is finding the balance between being open and selective about who you share revenue with and that’s where revenue sharing comes in handy.

Increased Accountability

One of the most significant advantages of revenue sharing is increased accountability. Partners are more likely to work harder and stay around longer when invested in the business. This is because they are vested in seeing it grow and succeed.

Higher Chance Of Funding

The revenue sharing model is a way for companies. To get funding that involves giving away part of their sales revenue. The idea behind this model is that the company will make more money in the long term. By giving away a smaller amount now rather than waiting for investors to pay back their investment with interest.

This model works well for companies with low sales volumes. And high margins because it gives them more time to grow their business before paying back their debt.

Provides Better Direction

The revenue-sharing model is an excellent option for any business that wants to grow and make more money. But doesn’t have the resources to do it independently. The revenue-sharing model allows you to focus on growing your business. While still getting the support of an experienced partner who can help you increase sales, margins, and profits.

Your Earning Is Not Consistent

Revenue sharing is a great way to earn money, but it’s not predictable. When you use revenue sharing to make money, you’re not guaranteed any particular amount of money every month or every year. You get whatever amount you earn from your sales or other passive activity.

It’s important to note that this can be both good and bad, depending on your goals and aspirations. If you want a consistent flow of income, then this might not be the right kind of work for you.

However, if you’re looking for the chance to earn more money than you could with other types of work, this might be an excellent opportunity.

Product Is Not Much Appealing

Another risk is that the product will not be successful in the market. This could happen if it does not sell well or if there are problems with customer service or delivery times that lead to dissatisfied customers who leave negative reviews online. These negative reviews can lead to lower sales and even customer abandonment of your business.

What Matters Should Be Covered in a Revenue Sharing Agreement?

If you’re looking to start your own business, you must understand how revenue-sharing agreements work and what matters should be covered in the agreement. This will help with planning and ensure your new venture is successful from day one.

The parties involved have to determine what capital will be contributed by each party, whether it’s equity or cash, and how that contribution will be calculated.

These details must be carefully considered so both sides understand their rights and responsibilities under the agreement. In this post, we’ll explore some of the most important considerations when drafting a revenue-sharing agreement:

The Term Of The Agreement

You should also include the term of the agreement, which is how long it will last. There may be a time limit on your revenue-sharing agreement, or you may have an indefinite arrangement with no specified end date.

If either party terminates the contract before its expiration date, they must pay a fee. Additionally, if one side amends (or changes) their revenue sharing agreement without consulting with the other party first and then the amendments cause negative consequences for that person’s business or brand image—such as an increase in overhead costs—they could demand compensation from you under one of these clauses:

The Amount Of The Contribution

The contribution amount is one of the most important aspects of a revenue-sharing agreement and should be clearly outlined in your contract. It includes how much each party will contribute, when they contribute, and whether any other financial obligations are associated with the agreement, such as taxes or additional fees.

Think about it this way: if you’re helping someone sell their products or services, you want to know exactly how much money they’ll be paying you for your services so that you can figure out how long it will take until you see any return on investment (ROI).

The same goes for them—they want to know exactly how much money they need from each sale before covering their costs and making a profit.

The Profit Sharing Formula

The profit-sharing formula is the heart of your revenue-sharing agreement. This section determines how you will share your product’s benefits, costs, and risks.

The most common profit-sharing formulas are:

- 50/50 – Both parties share all profits equally (and receive nothing if no profits exist).

- Fixed Percentage – One party receives a fixed percentage of the profits or losses. For example, if one party contributes $1 million and another contributes $10 million to develop a product which generates $15 million in sales, both parties receive $5 million in profit ($15 – 10 – 1).

- Rolling Up – The amount paid for each consecutive year’s investment is added until one party has contributed more than half of all contributions made to date. In this case, after five years’ worth of investments has been rolled up together, whichever party has contributed more gets 60% of the total revenue generated by sales over their original investment amount; any remaining amounts get divided between both parties by rolling down each successive year’s contribution until such time that only one party has paid more than half again (i.e., four years’ worth).

How Expenses Are Treated

- Expenses are a tricky part of revenue-sharing agreements, especially if you’re unfamiliar with the industry.

- Some expenses can be shared, while others cannot.*

For instance, a grocery store might share its costs and gross profit margin with the supplier. However, it would not necessarily want to share its marketing or labour costs with that supplier.*

If you were selling office supplies in bulk: You would likely want to split how much is spent on each product because they all have different profit margins and selling prices.*

Taxes

Many businesses will agree to a revenue-sharing agreement because it’s a win-win for everyone involved. However, taxes are probably the most important thing you should consider when negotiating your agreement. If you’re not careful, tax considerations can affect how much money you receive from a revenue-sharing agreement.

For example, if you own a business and have employees who work on your company’s products, those employees may be compensated with stock instead of cash. This is common in startups where owners want to build their companies without paying huge amounts of tax on their profits immediately (which would otherwise eat into their wealth).

It’s also helpful when an employee wants more control over their career path than they could get at another company—they could start working part-time with another firm while continuing full-time at yours. At the same time, they wait until they’re satisfied with their progress before deciding whether or not they should leave entirely.

However, if one partner receives more benefits than another due to this policy, then there might be trouble ahead: I’m sure there’ll be some audit soon enough.”

Controlling Interest

Controlling interest should be covered in a revenue-sharing agreement because it is crucial to the business’s success. If you do not have ownership of the business, you will not be able to make decisions that are in the company’s best interest.

You may lack knowledge about what needs to be done, or you may not have enough power to implement changes that need to be made.

In many cases, controlling interest is not covered in a revenue-sharing agreement. This can lead to some problems down the line, such as disagreements about whether or not specific actions were part of the original agreement.

If no controlling interest is defined in your revenue-sharing agreement, it’s essential to ensure you have one before you begin working on your project together.

Future Funding

Revenue sharing agreements are the best way to ensure that your future funding needs are met. For example, if you want to expand your business and hire new employees, you must ensure that your revenue will be sufficient to cover these expenses.

A revenue-sharing agreement can help you achieve this goal by providing a reliable source of funding that is not tied to a specific project or product.

Future funding is also crucial because it allows you to grow your company without taking on debt or selling off the equity for the expansion project to become a reality.

In some cases, this type of financing can even be used as an alternative method for raising capital when traditional methods aren’t available due to tight credit markets or other factors affecting their availability.

When To Consider Revenue Sharing Business Model?

Revenue sharing is a business model that allows you to share revenue with your partners. This partnership is excellent for businesses that want to work with companies in different industries.

But the question is, when should you consider revenue sharing? Relax, we are going to cover this point also. The right time to consider the revenue-sharing business model is as follows.

- When you need access to a new audience or product that you can’t afford on your own

- When you want to expand into a new market without investing a lot of money

- When you don’t want to take on the risk alone but believe in the idea enough to invest some money into it.

- When you have an idea for something new but don’t know where to start or how much it will cost

- When you need advice on how best to implement a certain strategy.

Reasons Why You Should Choose Revenue Dealer’s Revenue Sharing Business Model

Shared Success

By choosing Revenue Dealer’s Revenue sharing business model, the first benefit you will get is shared success.

In a traditional business structure, the participants are incentivized to focus on their success and not on the success of others. This creates an environment where there are winners and losers.

In a revenue-sharing investment, the focus shifts from individual gains to the collective good of all participants. This can be achieved by creating a shared purpose that serves as the foundation for all decisions made by each group member.

This is accomplished by creating a payout structure that rewards both the company and its investors. This helps create an environment where the focus is not solely on short-term gains but on relatively long-term growth.

Fixed Interest > Percent of Revenue

When you work with a revenue dealer, we take a percentage of your business’s gross revenue instead of a fixed interest rate. So When your business has a month with less revenue, you are less affected financially. So when your business has a month with less revenue, you are less dramatic financially.

We always want our clients to grow with us and don’t want only to take advantage of their business.

Keep The Initiative

Revenue Dealer allow entrepreneurs to retain full ownership of their company while providing a steady income stream.

In our revenue sharing agreement, an investor provides capital to a company in exchange for some percentage of the company’s future profits. The investor is not taking on any risk because they are not responsible for paying for any operating expenses or debts incurred by the company.

In this way, our revenue-sharing agreements allow entrepreneurs to retain control over their companies without giving up total ownership.

Potential for Investment

Our Revenue sharing business model is a great way to get funding for your business. It is the best option for entrepreneurs who want to start their businesses but have no capital for investment.

The Revenue Dealer model has no fixed payment or revenue requirement. You only have to pay when you make profits from your business. The upside of this model is that it allows you to grow your business without worrying about expenses at the beginning stage.

Many entrepreneurs prefer this model because it does not require them to pay anything upfront or even put up any collateral for loans if they need one to start their business.

Removes The Complexity Of Equity

Another reason you should choose Revenue dealer’s revenue sharing business model is that it removes the complexity of equity.

In the traditional equity model, each participant has to contribute a certain amount of money or assets to the business. This can be significant for some people and, therefore, a barrier to entry for many. In addition, if someone wants to leave the company, they will have to sell their shares at a discount rate which is usually not favourable for them.

In our revenue-sharing business model, there is no need for equity since it does not require any capital investment on your part. You only pay a fee when you make a sale, and that’s all there is to it.

Conclusion

Overall, the revenue-sharing business model has proven to be a boon for start-ups and other companies that want to increase their chances of survival. At the same time, they figure out how to generate revenue.

So if you want to earn maximum revenue from your business, join our revenue-sharing business model right now and see how your business boosts.